About BFC

Established in 2023, the Baltic Finance Center at RTU Riga Business School is a regional think-tank and capacity builder. We conduct research and education activities, with a focus on FinTech and Financial regulation.

Mission

To leverage education and independent research to help develop well-functioning, innovative and sustainable financial services markets that fulfill their roles at individual, economic and societal levels.

WHO WE ARE

Our growing team and stakeholder network bring together and build bridges between practitioners, researchers and educators who share the center’s mission and mindset. In building this network, we aim to be locally embedded and globally connected.

The needs motivating the establishment of BFC are local, regional and global in scope. We develop our areas of focus through gap analysis and ongoing, iterative stakeholder engagement.

Who we are

Our growing team and stakeholder network bring together and build bridges between practitioners, researchers and educators who share the center’s mission and mindset. In building this network, we aim to be locally embedded and globally connected.

The needs motivating the establishment of BFC are local, regional and global in scope. We develop our areas of focus through gap analysis and ongoing, iterative stakeholder engagement.

NEEDS THAT PROMPTED THE CREATION OF BFC

Needs that Prompted the creation of BFC

What we do

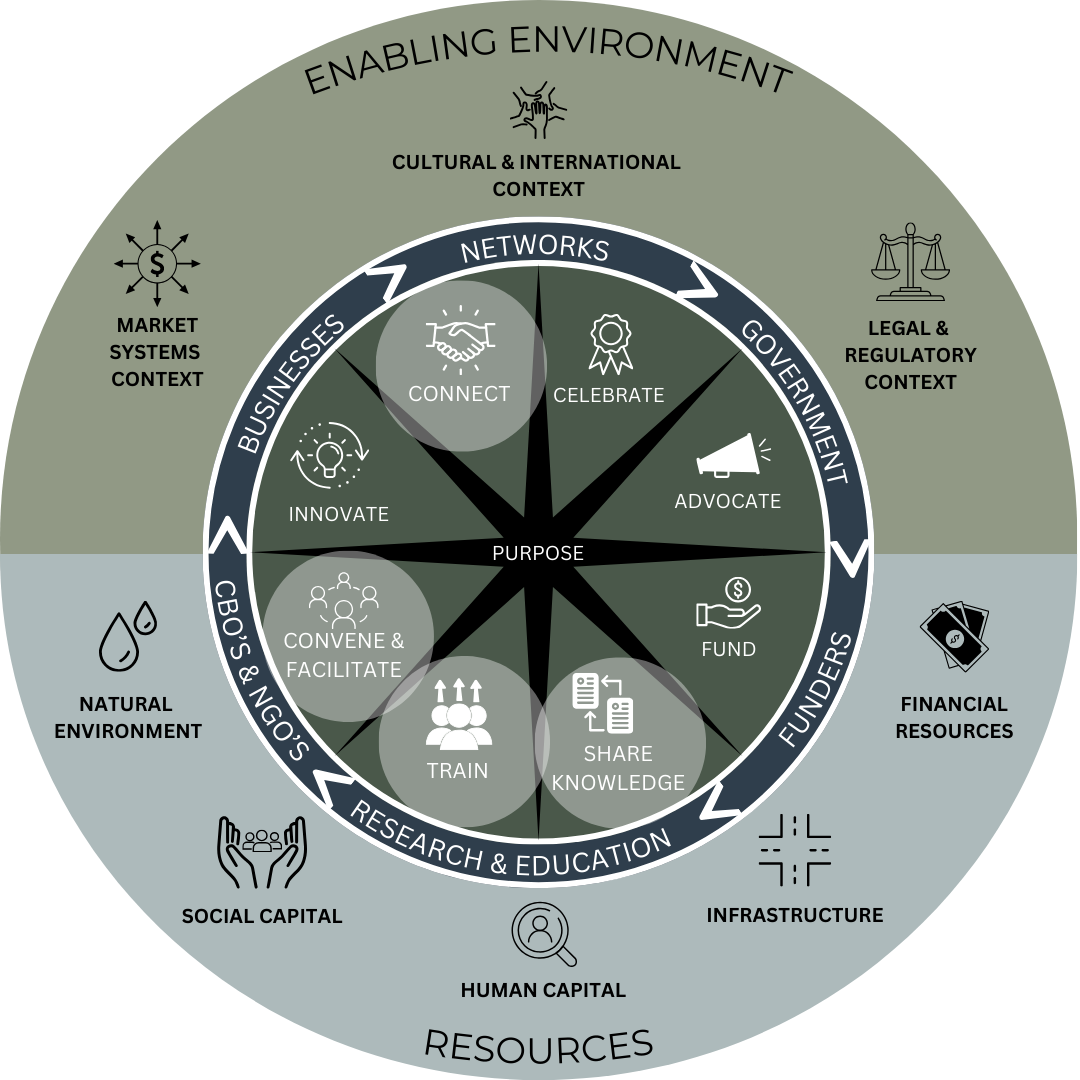

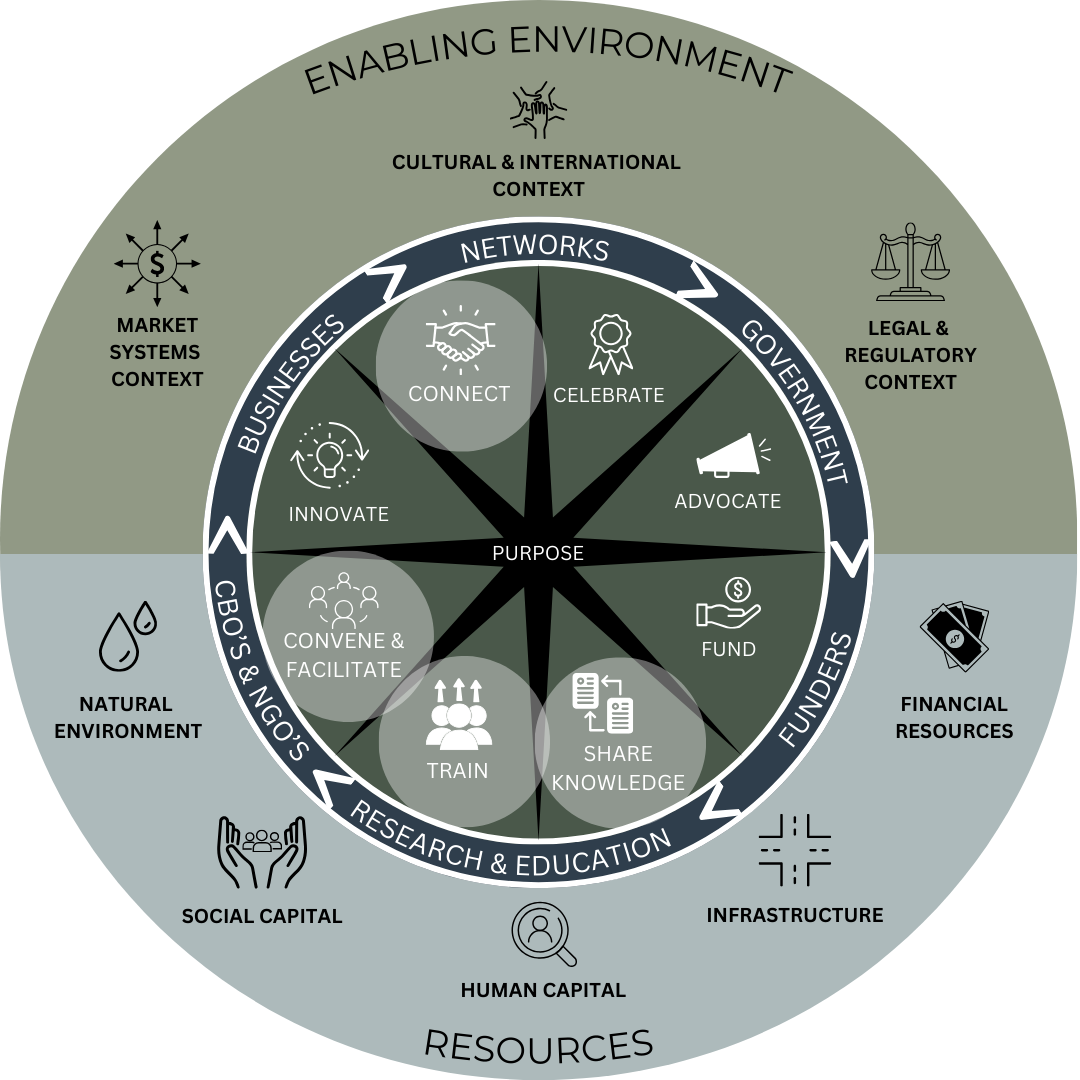

We see ourselves as part of the financial services ecosystem, where our specific role as an education and research institution is to train, produce and share knowledge, and convene and facilitate dialogue among different ecosystem participants. As an independent institution, BFC can provide a holistic and unique perspective on the ecosystem, its challenges and opportunities.

We carry out research and educational activities across all areas of financial services. Our initial program of work (2023-2026) is generously funded by the EU Recovery and Resilience Facility, and we will seek to expand our areas of work over time.

This model of the innovation ecosystem and the roles that various stakeholders play is from MIT, specifically their D-Lab and Practical Impact Alliance. The highlighted roles are the ones through which we as the Baltic Finance Center can contribute to the overall ecosystem and growth that is to come.

LOCAL

- Incomplete ecosystem – lack of independent thought leadership to support industry and policy makers

- Limited analytical capacity in academic institutions

- Strength in crisis management, weakness in anticipatory analysis

- Gaps in high-quality financial services educational provision

REGIONAL

- Interconnected financial services markets but insufficiently coordinated analysis of regional data and issues

- Fragmented and partial regional response to global issues (e.g. green finance, ‘smart’ sanction enforcement, behaviorally informed regulation)

- Competition over collaboration – risks of regulatory arbitrage

GLOBAL

- Need to strengthen the global debate and policy design by providing evidence-based regional analysis and proposals

- Analytical capacity not equally distributed – need for value-for-money investment in local capacity building

WHAT WE DO

We see ourselves as part of the financial services ecosystem, where our specific role as an education and research institution is to train, produce and share knowledge, and convene and facilitate dialogue among different ecosystem participants. As an independent institution, BFC can provide a holistic and unique perspective on the ecosystem, its challenges and opportunities.

We carry out research and educational activities across all areas of financial services. Our initial program of work (2023-2026) is generously funded by the EU Recovery and Resilience Facility, and we will seek to expand our areas of work over time.

This model of the innovation ecosystem and the roles that various stakeholders play is from MIT, specifically their D-Lab and Practical Impact Alliance.

The roles with an *asterisk* on both sides are the ones through which we as the Baltic Finance Center can contribute to the overall ecosystem and growth that is to come.

RESEARCH AND

INSIGHTS

- Policy-oriented applied and academic research that provides an independent, holistic, and pragmatic perspective on the current state, risks, and opportunities in the financial services sector.

- Identified through gap analysis and stakeholder engagement.

- Focuses on issues of both local and global relevance.

EDUCATION AND

TRAINING

- Education and training in specialized areas of financial services – essential to our role as an educational institution within the innovation ecosystem.

- Develop courses addressing clear gaps and stakeholder needs, building on our business school roots.

- Inaugural courses in FinTech business education, with plans to expand the training offer over time.

ECOSYSTEM

FORUM &

KNOWLEDGE

SHARING

- An impartial forum to facilitate collaborative dialogue and pool insights and expertise.

- Create a space for collectively navigating and tackling complex issues affecting financial service market development.

Project information

During 2023-2026, the Center will receive €1.5m in funding from the European Commission’s Recovery and Resilience Facility to carry out project No. 5.2.1.1.i.0/1/23/I/CFLA/001 “Knowledge and Research Capacity Strengthening of Anti-Money Laundering, Financial Sector Technology and Analysis” to strengthen knowledge and research capacity in the areas of financial regulation, anti-money laundering, FinTech, and sectoral analysis.

As part of the project, the Center will:

- Create 6 academic study modules on FinTech & financial regulation based on the best global course materials, train faculty from universities across Latvia, and deliver these courses to at least 150 undergraduate and graduate students.

- Carry out policy-focused applied research: produce 3 annual flagship reports and 6 policy briefs or occasional papers.

- Carry out academic research (at least 4 publications).

PROJECT INFORMATION

During 2023-2026, the Center will receive €1.5m in funding from the European Commission’s Recovery and Resilience Facility to carry out project No. 5.2.1.1.i.0/1/23/I/CFLA/001 “Knowledge and Research Capacity Strengthening of Anti-Money Laundering, Financial Sector Technology and Analysis” to strengthen knowledge and research capacity in the areas of financial regulation, anti-money laundering, FinTech, and sectoral analysis.

As part of the project, the Center will:

- Create 6 academic study modules on FinTech & financial regulation based on the best global course materials, train faculty from universities across Latvia, and deliver these courses to at least 150 undergraduate and graduate students.

- Carry out policy-focused applied research: produce 3 annual flagship reports and 6 policy briefs or occasional papers.

- Carry out academic research (at least 4 publications).

Transparency

The main asset of BFC is its independence, professional integrity, and objectivity. We will ensure that all those conducting research for the Center adhere to the highest research integrity standards. Any potential conflicts of interest through other affiliations will be appropriately managed and disclosed according to internal policies. Our staff adheres to the RTU Riga Business School and Riga Technical University policies on academic integrity.

We will always publicly disclose all our funding sources to ensure full transparency and manage any potential conflicts of interest.

TRANSPARENCY

The main asset of the BFC is its independence, professional integrity, and objectivity. We will ensure that all those conducting research for the Center adhere to the highest research integrity standards. Any potential conflicts of interest through other affiliations will be appropriately managed and disclosed according to internal policies. Our staff adheres to the RTU Riga Business School and Riga Technical University policies on academic integrity.

We will always publicly disclose all our funding sources to ensure full transparency and manage any potential conflicts of interest.

Our current supporters

OUR CURRENT SUPPORTERS

Executive team and staff

EXECUTIVE TEAM AND STAFF

Kristīne

Dambe

Founding Director

“Whether you think you can, or you think you can’t, you’re right.”

Henry Ford

Nauris

Bloks

Education Stream Lead and Fintech Business Models Course Lead

“My personal mission is to share knowledge and experience to cultivate a new generation of FinTech founders that can transform our region.”

Lelde

Kiopa

Education Project Manager

“Making my contribution to quality education in Latvia.”

Linda

Liepkalne

Stakeholder Engagement Coordinator

“At Baltic Finance Center, I bridge academia and industry to drive innovation and build knowledge that makes a real impact.”

Māra

Robežniece

Senior Communication Specialist

“I joined BFC so that you can learn about the great things BFC people are doing…”

Sigita

Pauliņa

Project Administrative Lead

Research and education

RESEARCH AND EDUCATION

Inese

Lazdovska

FinTech Regulation Course Lead

“I’m thrilled to become part of BFC and lead the course on FinTech regulation to contribute to the understanding of this topic in the Baltics.”

Vadims

Diordijevs

Fintech Regulation Course Lecturer

“RBS is a perfect place for quality financial education. I believe that motivated and skilled professionals can change the world, and our task is to give them practical tools for that.”

Zane

Oliņa

Instructional Design Specialist

“Through engaging and relevant learning, we can bring new players and bring greater capacity to the field.”

Andrejs

Jākobsons

Senior Researcher, Industry Advisor

“Financial freedom rarely comes without knowledge of finance and economics. Let’s work on this together!”

Madara

Ambrēna

Senior Researcher, Industry Advisor

“BFC’s mission to empower policymakers with data aligns well with my passion for evidence-based financial regulation.”

Claudio

Rivera

Lead Researcher

“I am involved in this because I believe that economic growth relies on entrepreneurship, a healthy financial system, and transparent public finances.”

Zakia

Siddiqui

Senior Researcher

“Engaging with BFC merges my passion for academia and industry, fostering innovation and impactful solutions in financial services.”

Vytautas

Kuokštis

Lead Researcher

“I am interested in analyzing the political economy of Fintech, specifically the political and institutional drivers of Fintech regulation and development.”

Edgars

Voļskis

Senior Researcher

“To acquire new knowledge and skills, one must study a lot. To add value to newly acquired skills and knowledge, scientific and practical research must be conducted. I always enjoy both—studying and researching.”

Development council

DEVELOPMENT COUNCIL

The BFC Development Council serves as an advisory body for the center and provides a liaison mechanism for stakeholders from across the ecosystem to engage with us.

The BFC Development Council serves as an advisory body for the center and provides a liaison mechanism for stakeholders from across the ecosystem to engage with us.

Ainārs

Ozols

Professional Board Member and Chairman

Uldis

Cērps

Head of Finance Latvia Association

Robin

Taylor

Executive Director, Lawyers Without Borders

Richard

Parlour

Chairman, EU Task Force on Cybersecurity Policy for the Financial Sector; CEPS Rapporteur, EU Task Force on AML Effectiveness

Andris

Bērziņš

Partner, Change Ventures; Co-Founder and Chairman, TechHub Riga

Inese

Muzikante

Director, RTU Riga Business School

Viesturs

Kuļikovskis

Board Member, RTU Riga Business School Advisory Board