PAR BFC

Baltijas Finanšu centrs tika izveidots 2023. gadā ar mērķi veidot reģionālu, neatkarīgu domnīcu un celt zināšanu kapacitāti finanšu sektorā. Mēs īstenojam pētniecības un izglītības aktivitātes, koncentrējoties uz FinTech un finanšu sektora tiesisko regulējumu.

MISIJA

Ar izglītības un neatkarīgas pētniecības palīdzību veicināt inovatīva, ilgtspējīga un labi funkcionējoša finanšu pakalpojumu tirgus attīstību, kas efektīvi strādā gan indivīda, gan tautsaimniecības un gan visas sabiedrības labā.

KAS MĒS ESAM

Mūsu komanda un atbalstītāju loks apvieno līdzīgi domājošus praktiķus, pētniekus un izglītības darbiniekus, kurus vieno kopīga misija. Veidojot šo tīklu, mums būtisks ir gan vietējais, gan starptautiskais aspekts.

Mēs attīstām savus darbības virzienus, izvērtējot vietēja, reģionāla un globāla mēroga nozares vajadzības un iesaistot ieinteresētās puses.

KAS MĒS ESAM

Mūsu komanda un atbalstītāju loks apvieno līdzīgi domājošus praktiķus, pētniekus un izglītības darbiniekus, kurus vieno kopīga misija. Veidojot šo tīklu, mums būtisks ir gan vietējais, gan starptautiskais aspekts.

Mēs attīstām savus darbības virzienus, izvērtējot vietēja, reģionāla un globāla mēroga nozares vajadzības un iesaistot ieinteresētās puses.

VAJADZĪBAS, KAS VEICINĀJUŠAS BFC IZVEIDI

VAJADZĪBAS, KAS VEICINĀJUŠAS BFC IZVEIDI

VIETĒJĀS

- Nepilnīga ekosistēma – trūkst neatkarīgu līderu, kas atbalstītu nozares un politikas veidotājus

- Ierobežota analītiskā kapacitāte akadēmiskajās iestādēs

- Spēcīga krīžu vadība, bet vāja risku analīze

- Trūkumi augstas kvalitātes finanšu pakalpojumu izglītības piedāvājumā

REĢIONĀLĀS

- Savstarpēji saistīti finanšu pakalpojumu tirgi, bet nepietiekami koordinēta reģionālo datu un problēmu analīze

- Sadrumstalota un nepilnīga reģionāla atbilde uz globāli risināmiem jautājumiem (piemēram, “zaļās” finanses, “gudra” sankciju ieviešana un uzvedībā balstīts regulējums)

- Konkurence, nevis sadarbība – regulējuma arbitrāžas riski

GLOBĀLĀS

- Nepieciešamība stiprināt globālās diskusijas un politikas izstrādi, sniedzot uz pierādījumiem balstītu reģionālo analīzi un priekšlikumus

- Analītiskā kapacitāte nav vienmērīgi sadalīta – nepieciešams ieguldījums vietējo spēju attīstīšanā, lai nodrošinātu lietderīgu līdzekļu izmantošanu

VIETĒJĀS

- Nepilnīga ekosistēma – trūkst neatkarīgu līderu, kas atbalstītu nozares un politikas veidotājus

- Ierobežota analītiskā kapacitāte akadēmiskajās iestādēs

- Spēcīga krīžu vadība, bet vāja risku analīze

- Trūkumi augstas kvalitātes finanšu pakalpojumu izglītības piedāvājumā

REĢIONĀLĀS

- Savstarpēji saistīti finanšu pakalpojumu tirgi, bet nepietiekami koordinēta reģionālo datu un problēmu analīze

- Sadrumstalota un nepilnīga reģionāla atbilde uz globāli risināmiem jautājumiem (piemēram, “zaļās” finanses, “gudra” sankciju ieviešana un uzvedībā balstīts regulējums)

- Konkurence, nevis sadarbība – regulējuma arbitrāžas riski

GLOBĀLĀS

- Nepieciešamība stiprināt globālās diskusijas un politikas izstrādi, sniedzot uz pierādījumiem balstītu reģionālo analīzi un priekšlikumus

- Analītiskā kapacitāte nav vienmērīgi sadalīta – nepieciešams ieguldījums vietējo spēju attīstīšanā, lai nodrošinātu lietderīgu līdzekļu izmantošanu

KO MĒS DARĀM

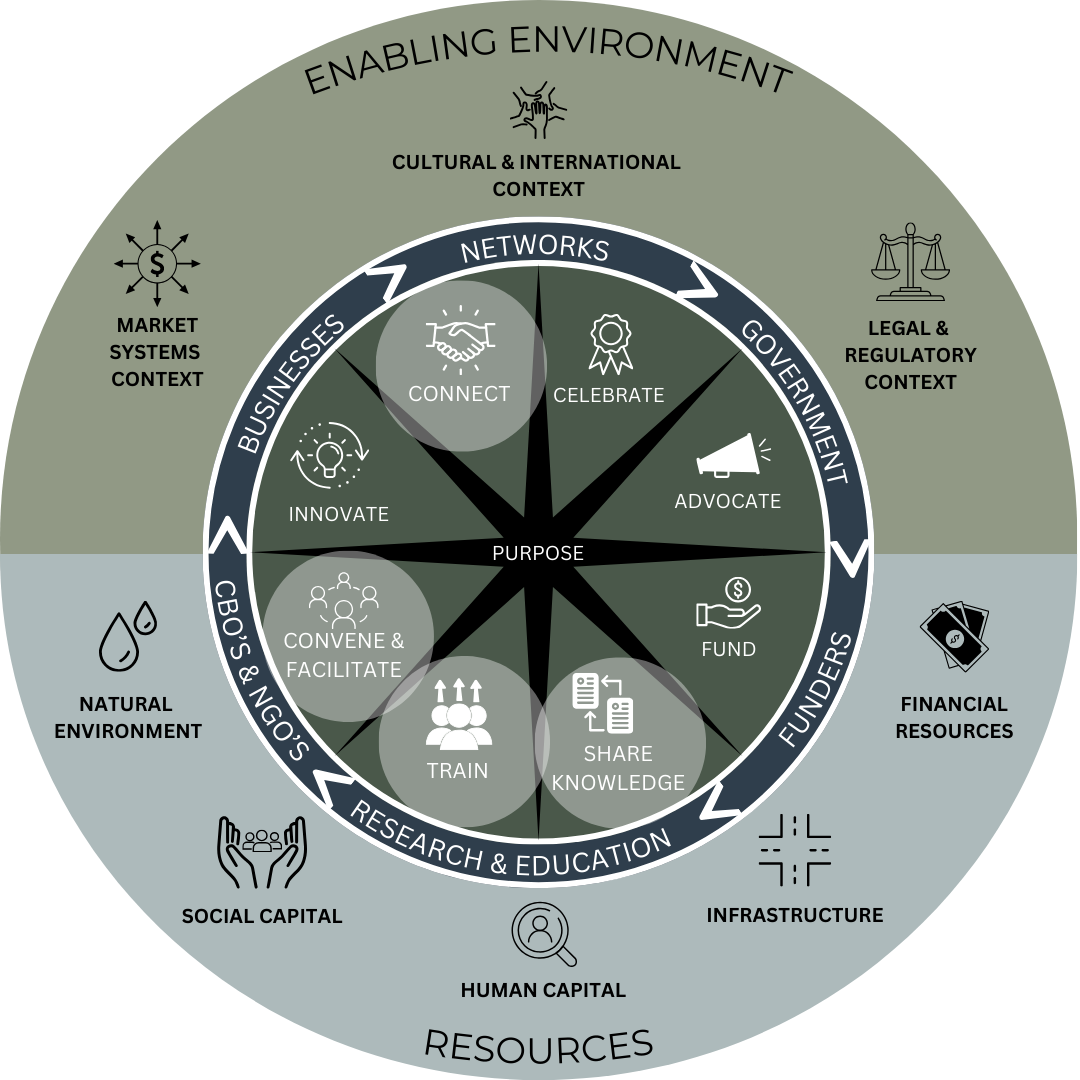

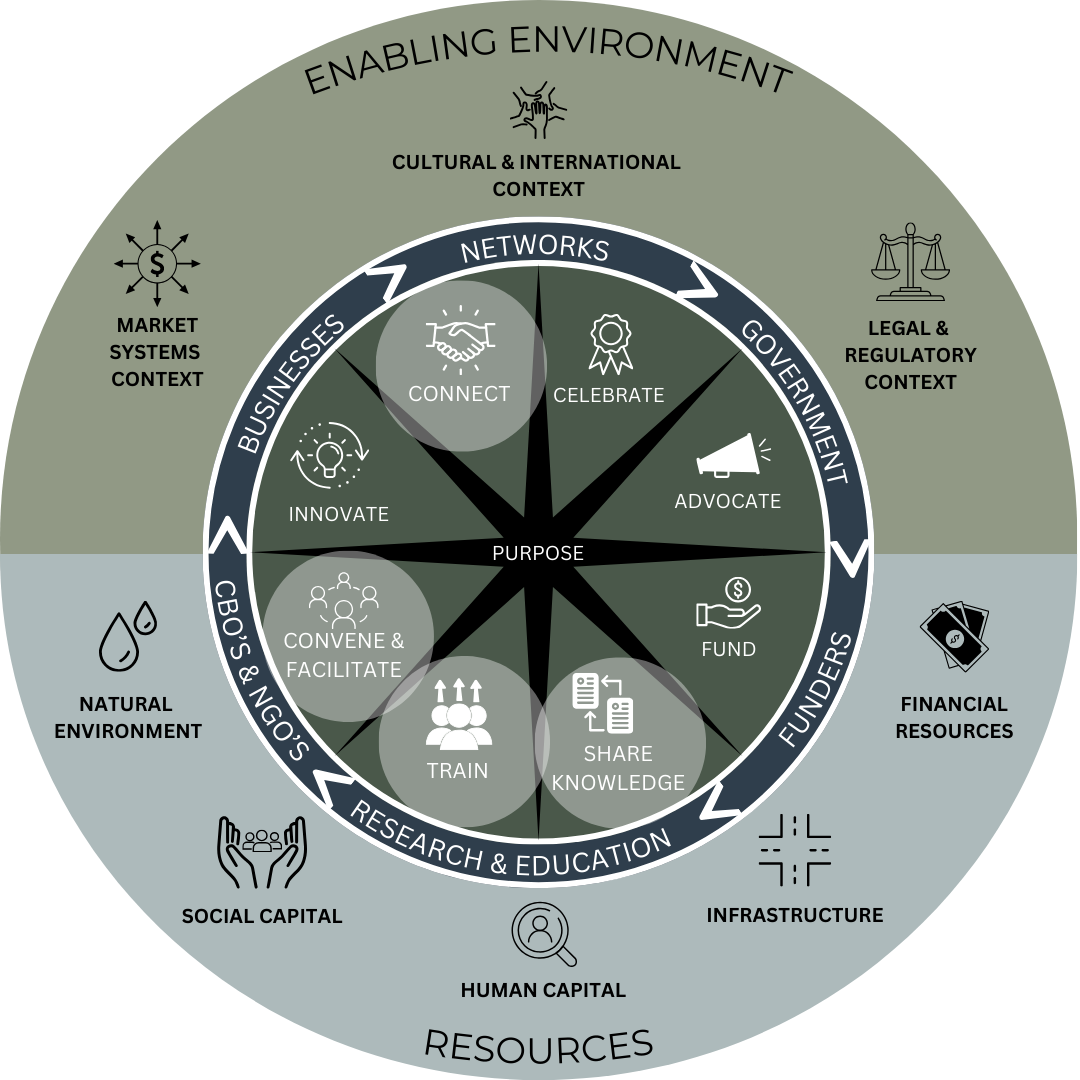

Mūsu kā izglītības un pētniecības iestādes loma finanšu pakalpojumu ekosistēmā ir apmācīt, radīt zināšanas, kā arī dalīties ar tām, veicinot dialogu starp dažādiem ekosistēmas dalībniekiem. Kā neatkarīga institūcija BFC spēj piedāvāt visaptverošu un unikālu skatījumu uz ekosistēmu, tās izaicinājumiem un iespējām.

Mēs veicam pētniecības un izglītības aktivitātes finanšu pakalpojumu jomās. Mūsu sākotnējo darba programmu (2023–2026) finansē ES Atveseļošanas un noturības mehānisms, un laika gaitā mēs plānojam paplašināt savu darbības lauku.

Šis inovāciju ekosistēmas modelis un dažādu iesaistīto pušu lomas ir izstrādāts Masačūstetsas Tehnoloģiju institūta (MIT) D-Lab and Practical Impact Alliance ietvaros. Izceltās lomas atspoguļo veidus, kā Baltijas Finanšu centrs var sniegt savu ieguldījumu kopējā ekosistēmā un tās turpmākajā izaugsmē.

KO MĒS DARĀM

Mūsu kā izglītības un pētniecības iestādes loma finanšu pakalpojumu ekosistēmā ir apmācīt, radīt zināšanas, kā arī dalīties ar tām, veicinot dialogu starp dažādiem ekosistēmas dalībniekiem. Kā neatkarīga institūcija BFC spēj piedāvāt visaptverošu un unikālu skatījumu uz ekosistēmu, tās izaicinājumiem un iespējām.

Mēs veicam pētniecības un izglītības aktivitātes finanšu pakalpojumu jomās. Mūsu sākotnējo darba programmu (2023–2026) finansē ES Atveseļošanas un noturības mehānisms, un laika gaitā mēs plānojam paplašināt savu darbības lauku.

Šis inovāciju ekosistēmas modelis un tajā ietvertās ieinteresēto pušu lomas ir izstrādāts Masačūsetsas Tehnoloģiju institūtā (Massachusetts Institute of Technology, D-Lab, Practical Impact Alliance).

Spilgtāk izceltas ir tās, kurās mēs kā Baltijas Finanšu centrs varam sniegt ieguldījumu kopējā ekosistēmā un gaidāmajā izaugsmē.

PĒTĪJUMI UN ATZIŅAS

- Uz politiku orientēti lietišķie un akadēmiskie pētījumi, kas sniedz neatkarīgu, holistisku un pragmatisku skatījumu uz pašreizējo situāciju, riskiem un iespējām finanšu pakalpojumu nozarē.

- Identificēti, veicot trūkumu analīzi un iesaistot ieinteresētās puses.

- Koncentrējas gan uz vietējiem, gan globāliem jautājumiem.

IZGLĪTĪBA UN APMĀCĪBAS

- Izglītība un apmācības specializētās finanšu pakalpojumu jomās – būtiska mūsu kā izglītības iestādes loma inovāciju ekosistēmā.

- Kursi, kas reaģē uz nozares nepilnībām un nozares pārstāvju vajadzībām. Izstrādāti, balstoties uz mūsu biznesa skolas pamatiem.

- Pirmie kursi fokusējas uz FinTech biznesa izglītību, laika gaidā plānots paplašināt apmācību piedāvājumu.

EKOSISTĒMAS FORUMS UN ZINĀŠANU APMAIŅA

- Neatkarīgs forums sadarbības dialoga veicināšanai, zināšanu un ekspertīzes efektīvai uzkrāšanai.

- Telpa, kur kopīgi risināt sarežģītus jautājumus, kas ietekmē finanšu pakalpojumu tirgus attīstību.

PĒTĪJUMI UN ATZIŅAS

- Uz politiku orientēti lietišķie un akadēmiskie pētījumi, kas sniedz neatkarīgu, holistisku un pragmatisku skatījumu uz pašreizējo situāciju, riskiem un iespējām finanšu pakalpojumu nozarē.

- Identificēti, veicot trūkumu analīzi un iesaistot ieinteresētās puses.

- Koncentrējas gan uz vietējiem, gan globāliem jautājumiem.

IZGLĪTĪBA UN APMĀCĪBAS

- Izglītība un apmācības specializētās finanšu pakalpojumu jomās – būtiska mūsu kā izglītības iestādes loma inovāciju ekosistēmā.

- Kursi, kas reaģē uz nozares nepilnībām un nozares pārstāvju vajadzībām. Izstrādāti, balstoties uz mūsu biznesa skolas pamatiem.

- Pirmie kursi fokusējas uz FinTech biznesa izglītību, laika gaidā plānots paplašināt apmācību piedāvājumu.

EKOSISTĒMAS FORUMS UN ZINĀŠANU APMAIŅA

- Neatkarīgs forums sadarbības dialoga veicināšanai, zināšanu un ekspertīzes efektīvai uzkrāšanai.

- Telpa, kur kopīgi risināt sarežģītus jautājumus, kas ietekmē finanšu pakalpojumu tirgus attīstību.

INFORMĀCIJA PAR PROJEKTU

No 2023. līdz 2026. gadam Baltijas Finanšu centrs saņems 1,5 miljonu eiro finansējumu no Eiropas Komisijas Atveseļošanas un noturības mehānisma, lai īstenotu projektu Nr. 5.2.1.1.i.0/1/23/I/CFLA/001 “Zināšanu un pētniecības kapacitātes stiprināšana noziedzīgi iegūtu līdzekļu legalizācijas novēršanas, finanšu tehnoloģiju un sektora analīzes jomās”, lai stiprinātu zināšanas un pētniecības kapacitāti finanšu regulējuma, noziedzīgi iegūtu līdzekļu legalizācijas novēršanas, FinTech un nozares analīzes jomās.

Projekta ietvaros Baltijas Finanšu centrs:

- Izveidos 6 akadēmiskos studiju moduļus FinTech un finanšu sektora tiesiskā regulējuma jomā, balstoties uz pasaules labākajiem kursu materiāliem, apmācīs pasniedzējus no Latvijas universitātēm un nodrošinās šos kursus vismaz 150 bakalaura un maģistra studentiem.

- Veiks uz politiku vērstu lietišķo pētniecību: izstrādās trīs gadskārtējos kompleksi analītiskos pētījumus un sešus specializētos ekspertīzes pētījumus.

- Veiks akadēmisko pētniecību (vismaz četras publikācijas).

INFORMĀCIJA PAR PROJEKTU

No 2023. līdz 2026. gadam Baltijas Finanšu centrs saņems 1,5 miljonu eiro finansējumu no Eiropas Komisijas Atveseļošanas un noturības mehānisma, lai īstenotu projektu Nr. 5.2.1.1.i.0/1/23/I/CFLA/001 “Zināšanu un pētniecības kapacitātes stiprināšana noziedzīgi iegūtu līdzekļu legalizācijas novēršanas, finanšu tehnoloģiju un sektora analīzes jomās”, lai stiprinātu zināšanas un pētniecības kapacitāti finanšu regulējuma, noziedzīgi iegūtu līdzekļu legalizācijas novēršanas, FinTech un nozares analīzes jomās.

Projekta ietvaros Baltijas Finanšu centrs:

- Izveidos 6 akadēmiskos studiju moduļus FinTech un finanšu sektora tiesiskā regulējuma jomā, balstoties uz pasaules labākajiem kursu materiāliem, apmācīs pasniedzējus no Latvijas universitātēm un nodrošinās šos kursus vismaz 150 bakalaura un maģistra studentiem.

- Veiks uz politiku vērstu lietišķo pētniecību: izstrādās trīs gadskārtējos kompleksi analītiskos pētījumus un sešus specializētos ekspertīzes pētījumus.

- Veiks akadēmisko pētniecību (vismaz četras publikācijas).

CAURREDZAMĪBA

BFC galvenā priekšrocība ir mūsu neatkarība, profesionālā integritāte un objektivitāte. Mēs nodrošināsim, lai visi, kas veic pētījumus Centra ietvaros, ievērotu visaugstākos pētniecības integritātes standartus. Jebkādi potenciālie interešu konflikti tiks atbilstoši pārvaldīti un norādīti saskaņā ar iekšējām vadlīnijām. Mūsu personāls ievēro RTU Rīgas Biznesa skolas un Rīgas Tehniskās universitātes akadēmiskā godījuma politiku.

Mēs vienmēr publiski norādām visus finansējuma avotus, lai nodrošinātu pilnīgu caurredzamību un novērstu iespējamos interešu konfliktus.

CAURREDZAMĪBA

BFC galvenā priekšrocība ir mūsu neatkarība, profesionālā integritāte un objektivitāte. Mēs nodrošināsim, lai visi, kas veic pētījumus Centra ietvaros, ievērotu visaugstākos pētniecības integritātes standartus. Jebkādi potenciālie interešu konflikti tiks atbilstoši pārvaldīti un norādīti saskaņā ar iekšējām vadlīnijām. Mūsu personāls ievēro RTU Rīgas Biznesa skolas un Rīgas Tehniskās universitātes akadēmiskā godījuma politiku.

Mēs vienmēr publiski norādām visus finansējuma avotus, lai nodrošinātu pilnīgu caurredzamību un novērstu iespējamos interešu konfliktus.

MŪSU ATBALSTĪTĀJI

MŪSU ATBALSTĪTĀJI

VADĪBAS KOMANDA UN PERSONĀLS

VADĪBAS KOMANDA UN PERSONĀLS

Kristīne

Dambe

BFC direktore

“Neatkarīgi no tā, vai jūs domājat, ka varat vai domājat, ka nevarat, jums ir taisnība.”

Henrijs Fords

Nauris

Bloks

FinTech biznesa modeļu un FinTech biznesa idejas izstrādes kursu vadītājs

“Mana personīgā misija ir dalīties savās zināšanās un pieredzē, lai izaudzinātu jaunu FinTech dibinātāju paaudzi, kas nesīs pārmaiņas mūsu reģionā.

Lelde

Kiopa

Izglītības projektu vadītāja

“Es ieguldu kvalitatīvas izglītības īstenošanā Latvijā.”

Linda

Liepkalne

Programmas koordinatore

“Baltijas Finanšu centrā es savedu kopā akadēmisko vidi un industriju, lai attīstītu inovācijas un būvētu zināšanu bāzi, kam ir patiesa ietekme.”

Māra

Robežniece

Vecākā komunikācijas speciāliste

“Es pievienojos komandai, lai jūs uzzinātu par lieliskajām lietām, ko BFC dara.”

Sigita

Pauliņa

Projekta administratīvā vadība

PĒTNIECĪBA UN IZGLĪTĪBA

PĒTNIECĪBA UN IZGLĪTĪBA

Inese

Lazdovska

FinTech regulējuma kursa vadītāja

“Esmu priecīga kļūt par BFC daļu un vadīt kursu par FinTech regulējumu, lai veicinātu izpratni par šo tēmu Baltijā.”

Vadims

Diordijevs

Fintech regulējuma kursa pasniedzējs

“RBS ir perfekta vieta kvalitatīvai izglītībai finanšu jomā. Es ticu, ka motivēti un kvalificēti speciālisti spēj mainīt pasauli, un mūsu uzdevums ir nodrošināt viņiem nepieciešamās prasmes.”

Zane

Oliņa

Izglītības eksperte

“Caur saistošu un atbilstošu mācīšanos, mēs varam piesaistīt jaunus spēlētājus un paaugstināt sektora kapacitāti.”

Alexander

Apostolides

Vadošais pētnieks

“Zināšanu radīšana caur kapacitātes paaugstināšanu un pētniecību”

William

Schaub

Vecākais pētnieks, industrijas eksperts

“RBS ir īstā vieta Baltijas Finanšu Centram, un manā skatījumā tā misija un cilvēki ir pareizās komponentes, kas nepieciešamas, lai pozitīvi ietekmētu Latvijas finanšu pakalpojumu sektoru.”

Andrejs

Jākobsons

Vecākais pētnieks, industrijas eksperts

“Finanšu brīvība reti nāk bez zināšanām par finansēm un ekonomiku. Strādāsim pie tā kopā!”

Madara

Ambrēna

Vecākais pētnieks, industrijas eksperts

“BFC misija nodrošināt politikas veidotājiem iespēju izmantot datus labi sasaucas ar manu aizraušanos – faktos balstītu finanšu sektora regulējumu.”

Claudio

Rivera

Vadošais pētnieks

“Esmu daļa no Centra, jo uzskatu, ka ekonomiskā izaugsme ir atkarīga no uzņēmējdarbības, veselīgas finanšu sistēmas un caurspīdīgām valsts finansēm.”

Zakia

Siddiqui

Vecākais pētnieks

“Sadarbošanās ar BFC apvieno manu aizraušanos ar akadēmisko vidi un industriju, veicinot inovācijas un ietekmīgus risinājumus finanšu pakalpojumu jomā.”

Vytautas

Kuokštis

Vadošais pētnieks

“Mani interesē FinTech politiskās ekonomikas analīze, īpaši FinTech regulējuma un attīstības politiskie un institucionālie virzītāji. “

Edgars

Voļskis

Vecākais pētnieks

“Lai iegūtu jaunas zināšanas un prasmes, ir daudz jāstudē. Lai radītu pievienoto vērtību jauniegūtajām prasmēm un zināšanām, ir jāveic zinātnieskie un praktiskie pētījumi. Es vienmēr izbaudu abus: studēt un pētīt.”

Valts

Vītums

Pētniecības asistents

“Pievienojos šim projektam, lai izpētītu banku konkurences un inovāciju dinamiku Latvijas finanšu sektorā.”

Mārtiņš

Melnacis

Pētniecības asistents

“Es pievienojos BFC, lai sniegtu nozīmīgu ieguldījumu un paplašinātu savas zināšanas un pieredzi FinTech sektorā.”

ATTĪSTĪBAS PADOME

ATTĪSTĪBAS PADOME

BFC Attīstības padome darbojas kā Centra padomdevēja struktūra un nodrošina saziņas mehānismu, lai ieinteresētās personas no visas ekosistēmas varētu ar mums sadarboties.

BFC Attīstības padome darbojas kā Centra padomdevēja struktūra un nodrošina saziņas mehānismu, lai ieinteresētās personas no visas ekosistēmas varētu ar mums sadarboties.

Ainārs

Ozols

Padomes loceklis un priekšsēdētājs

Uldis

Cērps

Finance Latvia asociācijas vadītājs

Robin

Taylor

“Juristi bez robežām” (“Lawyers Without Borders”) izpilddirektore

Richard

Parlour

CEPS ES finanšu sektora kiberdrošības politikas darba grupas priekšsēdētājs, CEPS ES nelikumīgi iegūtu līdzekļu legalizācijas novēršanas efektivitātes darba grupas referents

Andris

Bērziņš

Change Ventures partneris, TechHub Riga līdzdibinātājs un priekšsēdētājs

Inese

Muzikante

RTU Rīgas Biznesa Skolas direktors

Viesturs

Kuļikovskis

RTU Rīgas Biznesa skolas padomes valdes loceklis